In August 2020, the State-owned Assets Supervision and Administration Commission (SASAC) officially launched the "World-Class Benchmarking Initiative" for key state-owned enterprises, deploying systematic arrangements to strengthen management systems and capabilities. SASAC emphasized the need to:

1.Comprehensively analyze best practices of global leading enterprises

2.Thoroughly identify weaknesses in corporate management systems

3.Continuously strengthen institutional frameworks across five core dimensions:

oGovernance systems

oOrganizational structures

oAccountability mechanisms

oExecution frameworks

oEvaluation methodologies

The initiative aims to holistically elevate the management competence and operational standards of SOEs.

Which enterprises require management enhancement? How to improve? To what standard? How to evaluate enhancement effectiveness?

Which enterprises require management enhancement?

• Central State-Owned Enterprises (SOEs)

• Provincially-Administered Key State-Owned Enterprises

• Medium/Large Enterprises experiencing growth bottlenecks requiring cross-industry management expertise

How to improve?

• Establish five core mechanisms as levers to comprehensively advance benchmarking initiatives, strengthen management systems and capabilities, and implement multi-dimensional enhancement actions.

• Deeply integrate digital technologies with business operations and processes, actively participate in national strategic priorities, build collaborative innovation platforms, develop innovation chains, optimize industrial chains, improve supply chains, and revitalize core business units.

• Enhance pragmatic cooperation with enterprises of diverse ownership types, continuously modernize corporate governance systems, and elevate competitiveness, innovation capacity, control, influence, and risk resilience.

• Align with corporate culture to develop specialized domain branding, strengthen brand asset management, and embark on transforming Chinese brands into global leaders.

• Sustain benchmarking efforts to institutionalize early achievements into permanent mechanisms, empowering outstanding enterprises to attain world-class status (cultivating industry leaders, niche champions, and hidden champions in specialized sectors).

To what standard should enterprise improve?

As required by the official notice: By 2022, key state-owned enterprises should achieve more advanced management philosophies and corporate culture, more robust institutional frameworks and operational processes, and more effective methodologies and tools. With consolidated management foundations and continuous innovation outputs, the goal is to essentially establish a comprehensive, scientific, and efficient modern state-owned enterprise management system with Chinese characteristics. This will significantly enhance overall management competence, enabling some key SOEs to reach or approach world-class standards.

Aligned with the principle of deriving value from management excellence, we help enterprises develop core management capabilities through organizational learning, unlock institutional potential and collective wisdom, and establish mechanisms to refine governance systems, streamline processes, and build standardized management frameworks. This includes developing professional operations systems, deploying agile digital infrastructure, and optimizing HR ecosystems to drive quality enhancement, performance growth, and operational efficiency through superior management practices.

How to evaluate enhancement effectiveness?

First, transform management issues across eight functional areas into quantifiable metrics, and assess the improvement of these metrics at six-month and annual intervals.

Second, decompose critical task lists to all business units, functional departments, and key positions, with regular completion and closure tracking.

Third, conduct quarterly satisfaction surveys for management roles, with timely adjustments and goal-oriented follow-ups.

China Stone's Benchmarking Enhancement Model

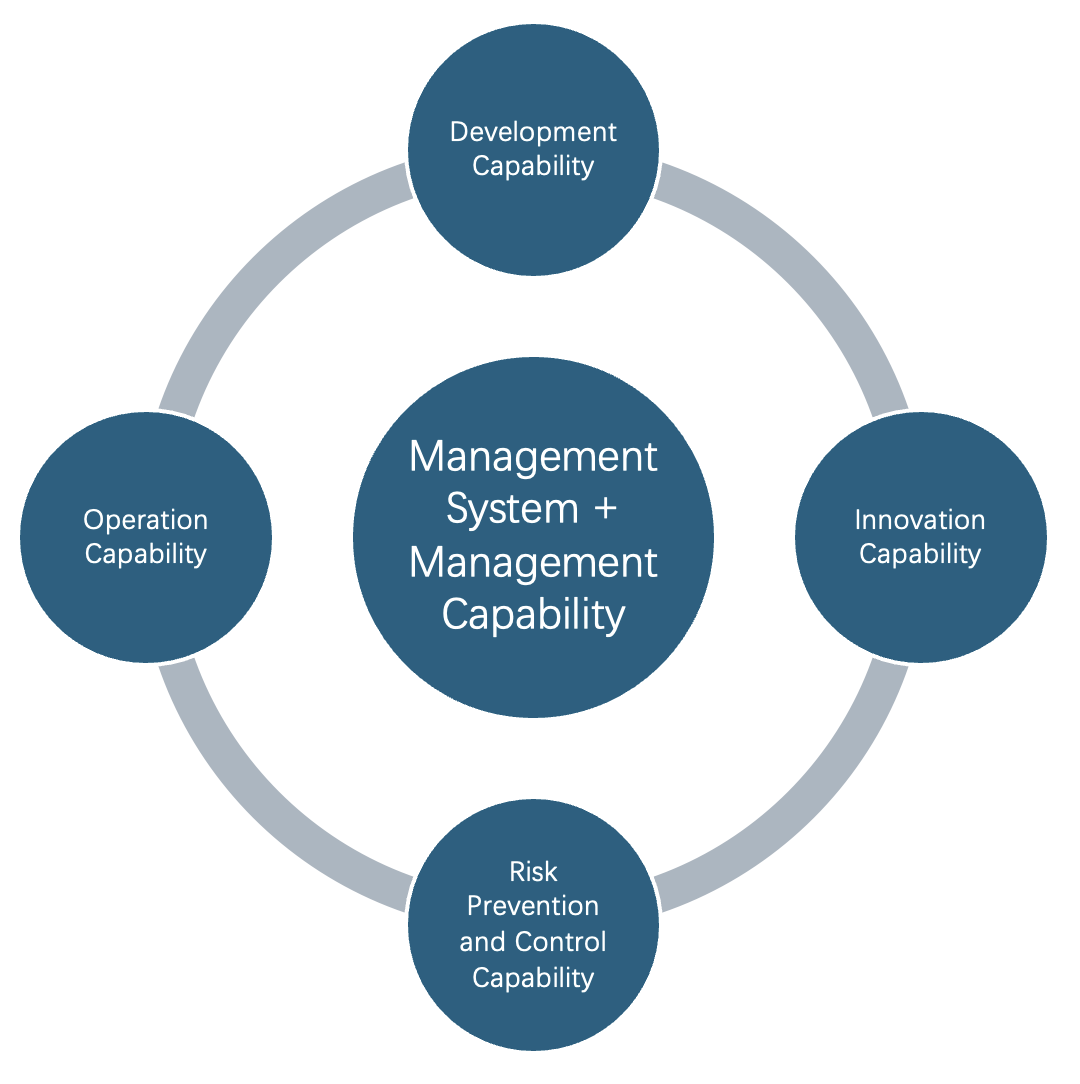

Ō¢Č China Stone's "Four-Dimensional Benchmarking Framework"

China Stone recommends adopting an integrated internal-external approach across four dimensions:

1.Development Capability

2.Innovation Capability

3.Operational Capability

4.Internationalization Capability/Risk Management

This framework deciphers the intrinsic growth patterns of world-class enterprises, focusing on two core initiatives:

•Management System Refinement

•Management Capability Advancement

The model ultimately addresses four critical gaps:

• Incomplete management policies

• Immature management frameworks

• Imperfect management mechanisms

• Ineffective execution

Ō¢Č Development Capability

The analysis of development capability primarily examines the following nine indicators:

•Revenue growth rate

•Capital preservation and appreciation rate

•Capital accumulation rate

•Total asset growth rate

•Operating profit growth rate

•R&D investment ratio

•Three-year average revenue growth rate

•Three-year average capital growth rate

•Proportion of international operating income

We select metrics that comprehensively and objectively reflect an enterprise's scale characteristics while maintaining international comparability, tailored to the specific industry context.

Ō¢Č Innovation Capability:

Innovation is both a process and an outcome, encompassing:

•Introduction of new products

•Adoption of novel production methods

•Development of new markets

•Sourcing of alternative raw materials

•Implementation of innovative organizational structures

Corporate profitability serves as the foundation and prerequisite for innovation. Only through sustained increases in R&D investment can enterprises maintain technological leadership.

Common metrics for evaluating innovation outputs include:

Ō£ō Intellectual property assets

Ō£ō Patent portfolio size

Ō¢Č Operational Capability:

Operational capability refers to an enterprise's capacity to achieve overarching business objectives through optimal allocation of internal financial, human, IT, and production resources within external market constraints.

In alignment with SASAC requirements, we evaluate operational capability using three core metrics:

•Overall labor productivity

•Return on equity (ROE)

•Cost-to-profit ratio

These indicators are analyzed across four dimensions to diagnose current status and identify improvement opportunities:

1.Financial management

2.Operations management

3.Human resource management

4.Digital management

Ō¢Č Risk Management Capability:

We focus specifically on building:

•Debt risk prevention mechanisms

•Compliance management systems

Using asset-liability ratio as the primary quantitative indicator, enterprises must balance:

Ō£ō Sustainable scale growth

Ō£ō Operational excellence

Ō£ō Market-oriented state capital utilization

Ō£ō Resource optimization

This involves establishing robust state capital investment/operation platforms—including capital service platforms and investment management platforms—to enhance:

• Capital operation capabilities

• Debt risk mitigation

Chinastone Proprietary Solutions

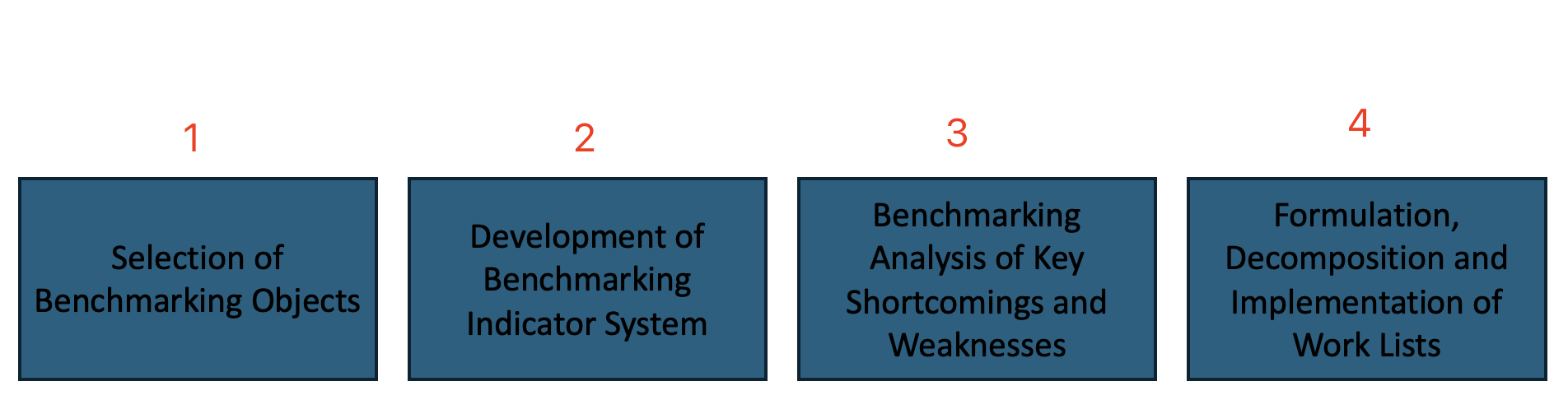

Ō¢Č Chinastone's "Four-Phase Benchmarking Excellence Framework"

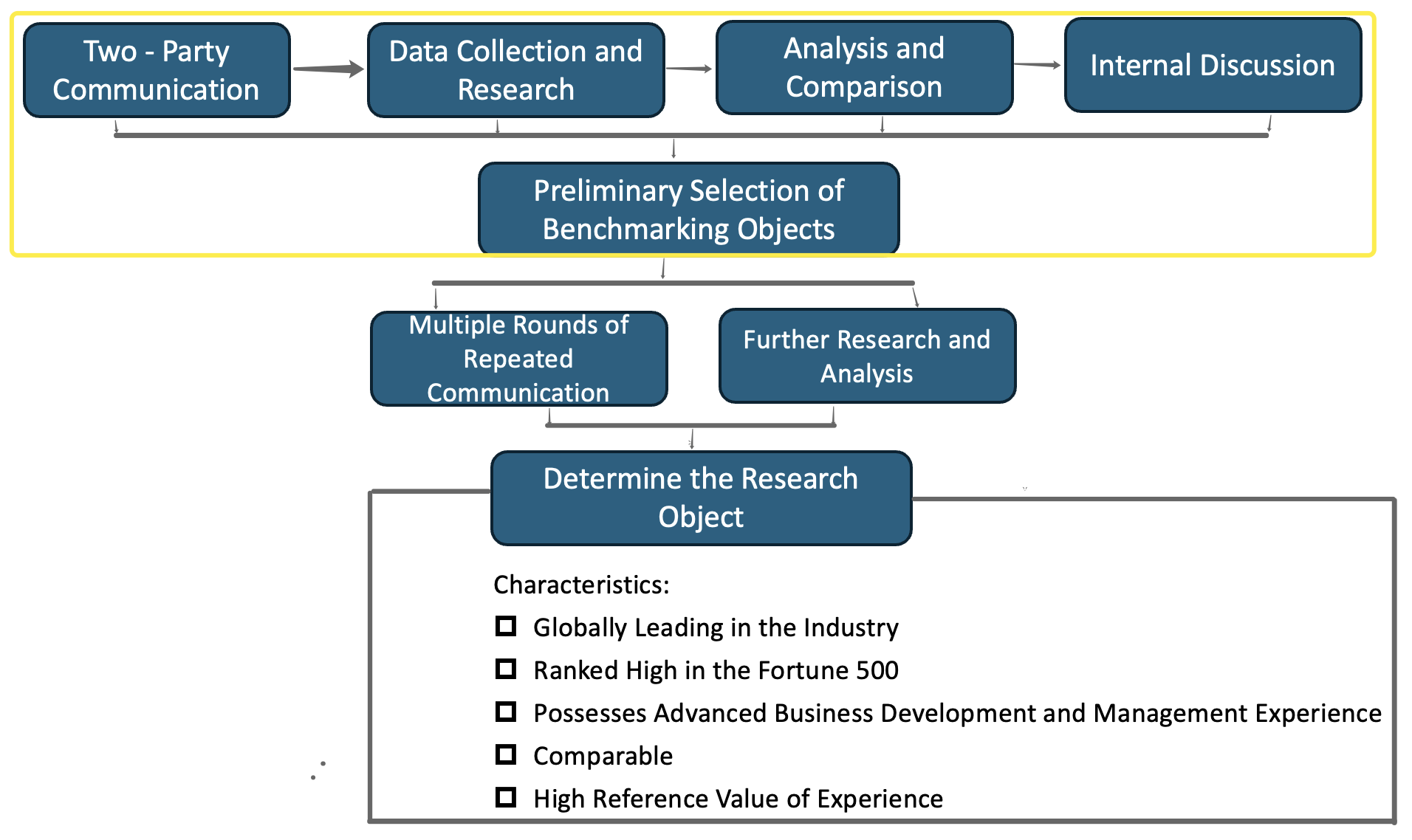

Ō¢Č Benchmarking Target Selection

Identifying appropriate benchmarking targets addresses the core question of "who to benchmark against," striving to achieve precise alignment.

The purpose of selecting benchmarking entities lies in rapidly identifying the parent company's own shortcomings through analyzing benchmark enterprises' products, services, and exemplary management practices. This process drives the parent company to enhance its capabilities and elevate its standards to industry-leading levels.

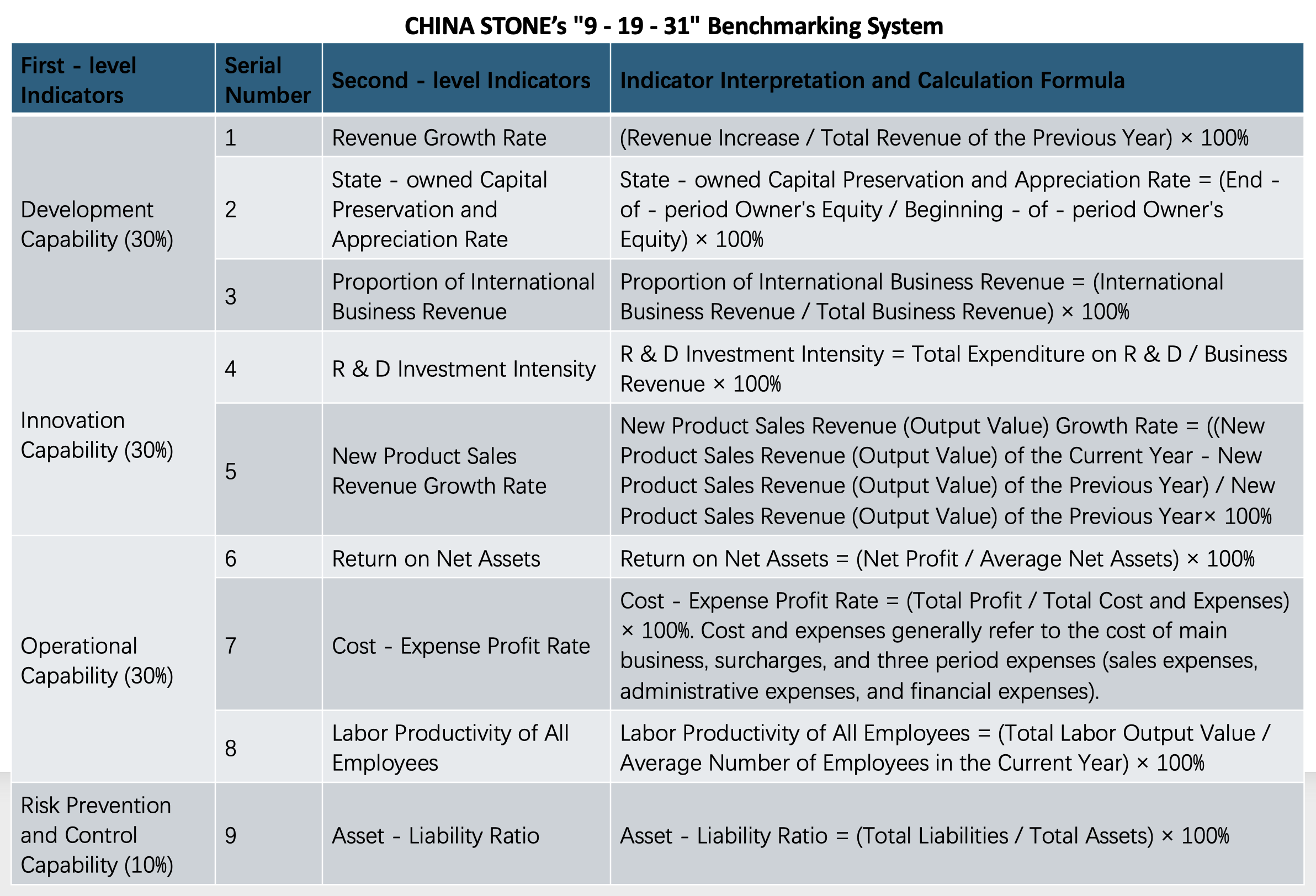

Establishment of Benchmarking Indicator System

The construction of the indicator system primarily addresses the question of "what to benchmark."

First, the indicator system must comprehensively reflect the enterprise's current status across eight functional domains: strategic management, organizational management, operations management, financial management, technological management, risk management, human resource management, and IT management. Simultaneously, it should encompass the three-tier architecture of the group headquarters, functional departments, and subsidiary companies.

Second, regarding the design of specific indicators, benchmarking against world-class enterprises requires emphasis on both:

•

Macro-level universal metrics (including return on equity, state-owned capital preservation and appreciation rate, cost-to-profit ratio, operating income profit margin, and overall labor productivity) that evaluate investment returns, operational quality and efficiency, innovation capability, and internationalization level;

•

Underlying drivers and influencing factors behind these quantitative indicators. For instance, analyzing how changes in return on total assets, total asset turnover, and capital structure impact return on equity. This involves examining the root causes and contributing elements from a micro-financial perspective, moving beyond "where the gaps exist" to "why the gaps emerge."

Furthermore, each specific indicator must ensure measurability and relative objectivity of measurement results in its design.

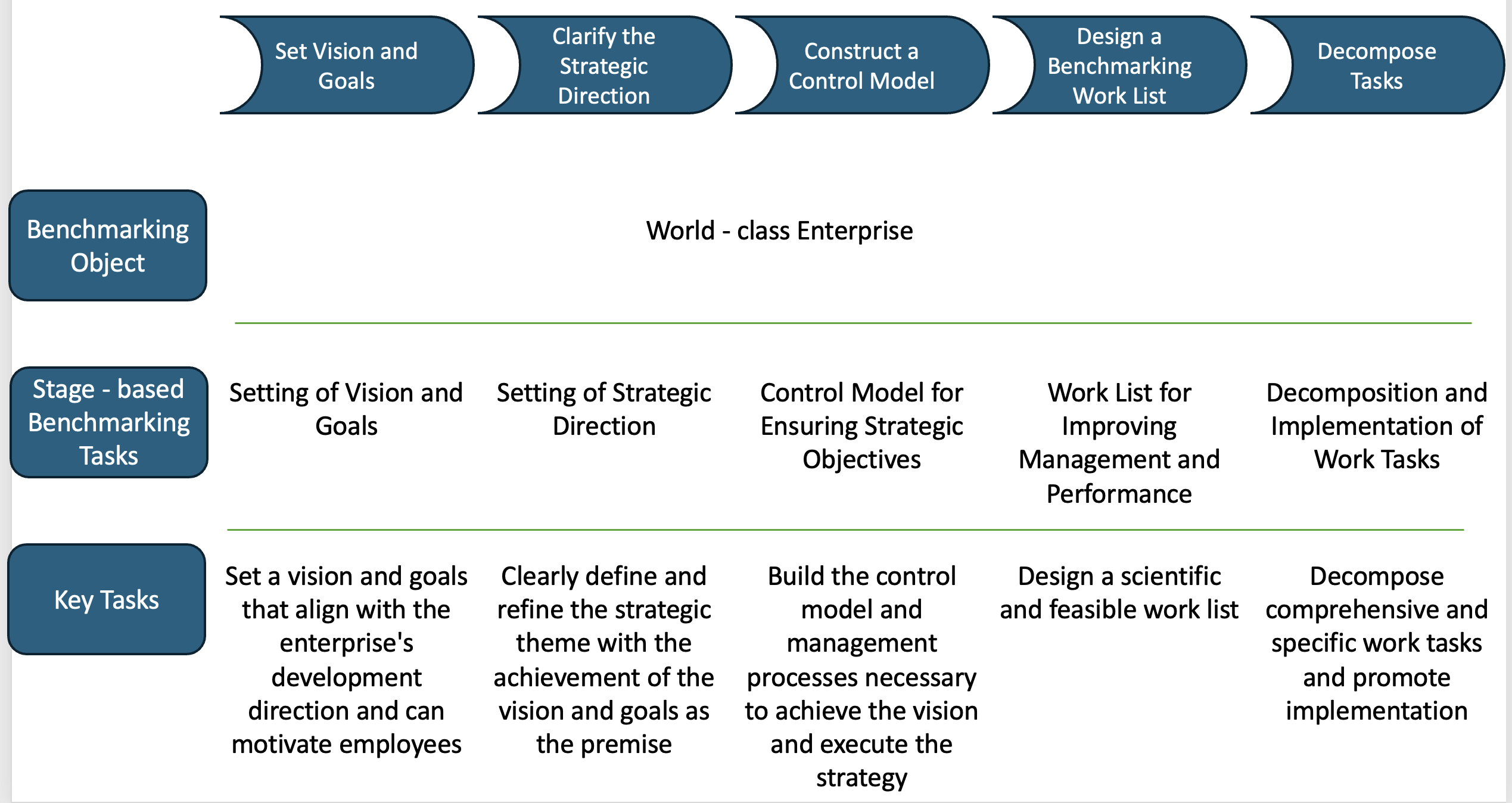

Decomposition and Implementation of Benchmarking Initiatives

Through comparative analysis with benchmarked entities, historical enterprise data analysis, and internal cross-divisional data comparisons, we identify the primary management shortcomings and weaknesses within an organization, addressing the fundamental question: "Where do the gaps lie?"

The core objective of benchmarking research is to uncover disparities in management capabilities and proficiency levels. Utilizing the established benchmarking indicator system, we conduct comparative analyses at three tiers—corporate level, functional departments, and subsidiary companies—against selected benchmark counterparts. This process distills the most critical capability gaps, using capacity building as the implementation vehicle to pinpoint and analyze existing deficiencies. By focusing on the principal contradictions, we isolate the "key shortcomings" and "critical weaknesses."

The initiative provides actionable recommendations for management enhancement, exploring solutions to "how to improve."

Building on the identified gaps in the management system, we conduct root cause analysis to diagnose the underlying origins of these deficiencies. This enables targeted interventions, yielding specific task lists for management improvement initiatives to be executed by functional departments and subsidiary companies.

Benchmarking Management Enhancement Initiative Consulting Deliverables

1.Analysis of Benchmark Enterprises' Management Practices and Success Models

2.Design of Benchmarking Indicator System (Categorized)

3.Establishment of External Benchmarking Database

4.Enterprise Management Capability Diagnostic Report

5.Cross-Industry Management Experience Application Feasibility Study

6.Operational Efficiency & Per-Capita Productivity Improvement Plan

7.Digital Transformation Application Design

8.Performance-Based Equity Incentive Mechanism for Key Technical and Management Personnel

9.World-Class Benchmarking Implementation Roadmap (Includes:

oInternal Research & Gap Analysis

oBenchmark Identification & Metric Selection

oOrganizational Implementation

oComparative Data Analytics

oRoot Cause Analysis

oCorrective Action Planning

oResults Consolidation

oStandard Operating Procedure Development

oSustainable Benchmarking Framework)

10.Benchmarking Execution Support:

oWeakness Identification

oCausal Analysis

oImprovement Methodology Development

11.Benchmarking Action Plan with Task Checklist

12.Benchmarking Training Program for Implementation Teams

13.Progress Tracking & Impact Evaluation